Ruthless Gold ETFs Strategies Exploited

작성자 정보

- Marla Calder 작성

- 작성일

본문

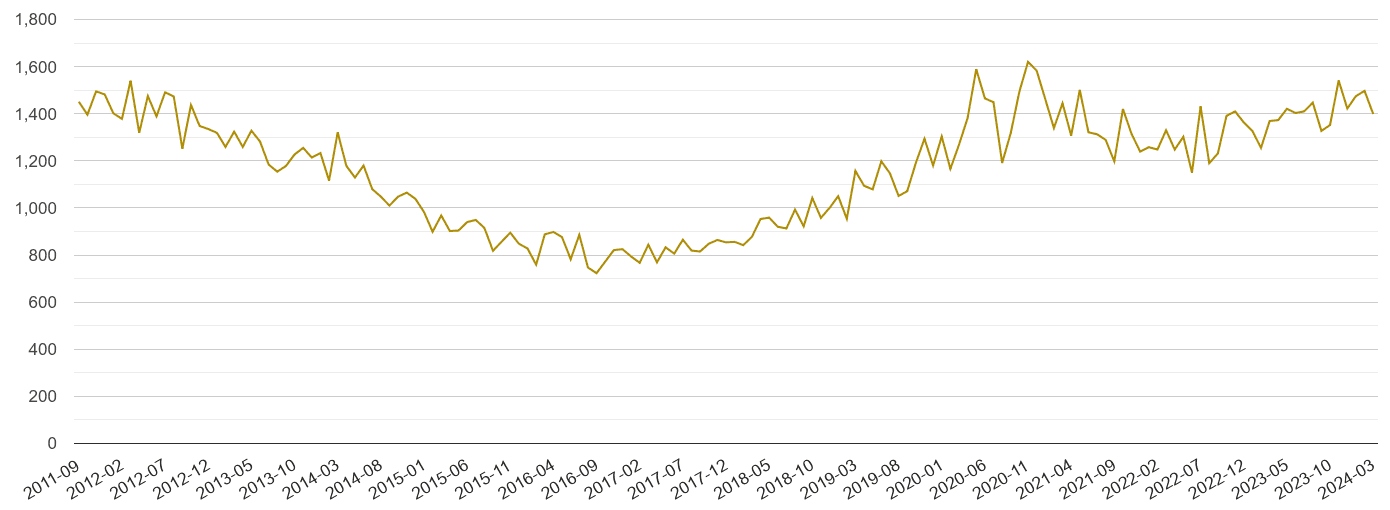

Thus far the differential gold-ETF-share selling has been trivial, with these combined GLD and IAU holdings only slumping 0.9% at worst to 1749.2t in mid-August. The defeated Japanese fare far worse, losing practically 5,000 soldiers. The broader the array of traders and speculators with quick access to gold, the extra capital can come into play to drive its worth around. Thus when gold ETFs’ holdings are falling, inventory-market capital is flowing again out of gold. So gold demand and thus gold costs would’ve collapsed if not crashed last quarter if not for epic gold-ETF demand, and collectively GLD and IAU accounted for nearly 2/3rds of that. American stock traders’ promoting both helped gasoline and exacerbated all these corrections, with the combined GLD and IAU holdings falling 13.1% or 156.7t, 6.3% or 69.5t, and 3.3% or 44.5t. It doesn’t take a lot gold-ETF differential selling to push gold sharply lower. Since gold’s dazzling all-time-document excessive of $2062 on August sixth, it has drifted sideways to lower. IAU is catching up with GLD because of a significant selling level really appealing to institutional investors, a lower expense ratio.

And two American gold-ETF giants completely dominate worldwide gold-ETF demand, the GLD SPDR Gold Shares and IAU iShares Gold Trust. In 2014, that same faculty pupil requires five professors, two paid teaching assistants and much more administrative help. Two or more grape varieties are almost at all times used to create Champagne. I may even assume you may have an inexpensive data of HTML at about the level supported by Netscape 1.1. On the other hand when this e book discusses newer elements of HTML that aren't yet in widespread use like cascading type sheets or the and tags, I will cowl them in depth. So everybody interested by the worth trends of gold, silver, and their miners’ stocks must intently watch GLD and IAU. Traders will notice gold stocks shouldn’t be trading as if gold was down close to $1,775. The herd of millennial traders is chasing huge and quick gains, and is fast to move on to the following surging thing. The new-cash Robinhood crowd that loves chasing momentum may simply lose interest with gold stalled for over a month now. Not surprisingly given GLD’s and IAU’s dominance over gold costs, their whole holdings peaked at a document 1765.0t that very same day gold crested.

And two American gold-ETF giants completely dominate worldwide gold-ETF demand, the GLD SPDR Gold Shares and IAU iShares Gold Trust. In 2014, that same faculty pupil requires five professors, two paid teaching assistants and much more administrative help. Two or more grape varieties are almost at all times used to create Champagne. I may even assume you may have an inexpensive data of HTML at about the level supported by Netscape 1.1. On the other hand when this e book discusses newer elements of HTML that aren't yet in widespread use like cascading type sheets or the and tags, I will cowl them in depth. So everybody interested by the worth trends of gold, silver, and their miners’ stocks must intently watch GLD and IAU. Traders will notice gold stocks shouldn’t be trading as if gold was down close to $1,775. The herd of millennial traders is chasing huge and quick gains, and is fast to move on to the following surging thing. The new-cash Robinhood crowd that loves chasing momentum may simply lose interest with gold stalled for over a month now. Not surprisingly given GLD’s and IAU’s dominance over gold costs, their whole holdings peaked at a document 1765.0t that very same day gold crested.

This secular gold bull has suffered three earlier corrections, 17.3% into late 2016, 13.6% into mid-2018, and 12.1% into March 2020’s pandemic inventory panic. Related to volatility and value, bull and bear markets even have an influence on the each day shopping for and promoting of precious metals such as gold and silver. Every main demand class collapsed except for gold ETFs. Traders who greedily rush into gold-ETF shares at relatively-high prices when euphoria runs rampant late in major gold uplegs rapidly undergo critical losses when gold subsequently corrects. So when gold-ETF-share shopping for or promoting outpaces or lags that in gold, ETF-share prices will decouple from gold’s and fail their tracking missions. That equalizes supply-demand differentials, synchronizing gold-ETF-share prices with gold’s. This gold bull’s precedent exhibits that when heavy differential gold-ETF-share buying flags, it usually presages coming differential selling. The WGC’s Q2’20 Gold Demand Trends report confirmed international demand being gobbled up by gold ETFs like Pac-Man!

Since GLD and IAU each report their bodily-gold-bullion holdings day by day, tracking their trends reveals whether or not American stock traders are buying or selling gold via these dominant ETFs. As this first chart exhibits, differential GLD and IAU shopping for has gone missing in action since gold peaked in early August. Potential catalysts abound that could spook the legions of speculators that flooded into gold-ETF shares in late July and early August forcing gold parabolic. That would inspire gold-futures speculators to dump gold. These weak hands frantically dump their gold-ETF shares, amplifying gold’s selloffs. Since gold price now’s latest early-August peak, IAU’s holdings actually climbed 3.7%! From Q1’20 to Q2’20, whole global gold-ETF holdings surged 13.7% sequentially to 3620.7 metric tons of bodily usd gold price bullion. That includes salaries of the individuals in addition to all the prices of bodily shifting and storing gold bullion. The neutral palette will accommodate a large number of shade selections in addition to bright patterns. They normally involve a extremely contagious, quick-killing pressure of some kind that forces the federal government to quarantine massive numbers of people - wholesome and sick - in an effort to cease a biological apocalypse. Take a look at what 786 people have written up to now, and share your personal expertise.

If you adored this information and you would such as to get additional info concerning سعر الذهب اليوم في الكويت kindly check out our own web site.